Customised financial planning

A good financial advisor takes care not only of your current situation, but also of your future. Remember that your assets do not develop statically; instead they are always in a state of flux.

A successful plan starts with an analysis

First, we do an analysis of your current situation and clarify which regular obligations you have to meet, which part of your assets is invested long-term and how this relates to your liquidity needs. We then take a close look at which aspects can be improved. Is there potential for optimisation in terms of taxation? Are there assets which could be invested in more profitable ways?

We plan your legacy according to your interests

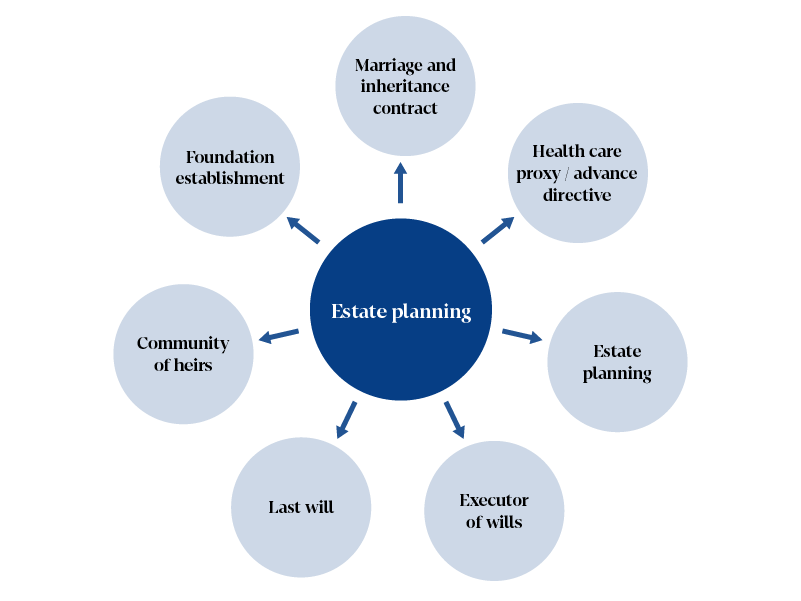

Would you like to ensure that your assets are passed on to the next generation as you intended? Let’s have a word then. Our specialists will be delighted to support you in drawing up marriage and inheritance contracts, drafting your will or setting up a foundation. Upon request, they can also act as executors of your will.

Prepare today, relax tomorrow

If you deal with your retirement planning at an early stage, you can look forward to your retirement with peace of mind. As part of our financial planning, we outline different scenarios for the future and explain how you need to be covered and get the best return on your investment at the same time.